Taxes and managing finances are not easy tasks to handle. It takes an expert to understand the dealings and detailing that goes into filing returns annually. CA services for business or CA services for tax are provided to aid businessmen and workers who are not too competent with their finances. However, it is often estimated that taxes are only for those who earn income from their source of employment. That is not true and the misconception needs to be cleared. That is why we will guide you through the elements and aspects of who needs to file these returns and when.

The main question of importance here is what kind of criteria are required to be fulfilled in order to become eligible for paying taxes. In an updated notification from the Income Tax Department, even housewives are supposed to file an income tax return, even if they are not earning independently. There are specific taxable transactions that we will be discussing further in the article, which accrues for filing these tax returns, irrespective of whether the receiver of such amounts has or does not have a separate source of income.

If the amount in your wife’s account is exceeding the threshold limit prescribed by the government on the amount for a non-earner, then too, she would have to file taxes to accommodate the sources of various income.

There are also questions surrounding the tax slabs that such income would fall in. The amount that any housewife will have to pay on various transaction amounts will also fall under the same category of taxes as is followed by the general earning class in the country. The parameters and limits are set in accordance with the amount of the taxable income. It is governed by the income tax laws that were passed by the parliament. Hence, you can study the files and restrictions on such transactions if you can hire CA services for tax to help you through the filing process.

As a housewife, there might be many questions surrounding you at this point in time like what are these transactions that are taxable even if you are not earning them, what do these transactions accrue for or what are the amounts that will be deducted as means of tax. We’ll take on these questions one by one. However, one must understand that filing these taxes is important for the security of the person as well as the national interest.

WHAT ARE THESE TAXABLE TRANSACTIONS?

The housewives are exempt from paying taxes over transactions that are not a source of her income, rental income, interest from fixed deposits, mutual funds or Nil investments. All the other mentioned sources of income are taxable for a housewife. These taxes are to be filed by either a housewife or can be assisted upon by any CA services for tax or business in a financial year.

It is a legal offence in the eyes of the law if you don’t file these taxes as a housewife who has already crossed the threshold exemption limit. According to the new amendments in the tax laws, a limit of exemption has been imposed through the budget to facilitate some easement in tax assessment for certain age groups. Some of these examples are –

- Any person who is below 60 years of age, earning less than 2.5 lakhs is exempt from filing taxes in any year.

- Any person who is above 60 years of age and has an earning of less than 3 lakhs doesn’t have to file returns.

- Any person over the age of 80 is exempt from paying taxes on the threshold earnings of 5 lakh rupees.

SOURCES OF TAXABLE INCOME FOR HOUSEWIVES

After understanding what taxable income means in terms of housewives who have other sources of income rather than their earnings, it is important to understand under what circumstances they will be taxed by the banks.

- INTEREST FROM FIXED DEPOSIT

If the interest earned from the fixed deposits by a housewife is above the exemption limit, then under the tax laws that are abided by all the citizens, so shall a housewife be liable to file her income tax returns on the interest. The tax that has to be paid on the fixed deposit was decided in the 1961 income tax act. The FDs are taxable according to the prevailing rate of tax under the financial budget.

However, if the interest on the fixed deposit accrued for the entire year is less than 40,000, then the bank doesn’t deduct the TDS. If the total sum of interest of all the fixed deposits is more than 40,000 in a financial year, then the banks will deduct 10% TDS. A major point to note is that the person should have their PAN card details registered with the bank. If this is not done, it can cause a penalty of 20% TDS deducted by the bank.

Another important thing to remember is that it is only possible for the bank to deduct tax on interest more than 40,000 if the total taxable income of the person is less than 2.5 lakhs. If the person’s income is less than 2.5 lakhs but they earn an interest of more than 40,000, there is no tax deductible for the same. If at any point of time, the tax is deducted by the bank mistakenly, then it can be refunded by filing an income tax return by the housewife, if the income is less than 2.5 lakhs.

- INVESTMENT IN THE NAME OF A HOUSEWIFE

If the money received from the husband’s income is invested in the name of the housewife, then in such a scenario, the income won’t be considered taxable from the account of the housewife since it is her husband’s income. This income is as good as his earnings which are taxed under his own name, meaning that these investments will be clubbed with his actual source of income and taxed according to the rate he falls under.

However, if in such a case, there is witnessed re-investment of this income from the end of the housewife, then it will be accrued to her income and tax will also be deducted in her name. For example, if a husband has invested 5 lakhs through his wife, the interest gained upon such investment, say 1 lakh, will be taxable under his name. However, if the amount of interest, which is 1 lakh is re-invested by the housewife, then any profit or interest on the same will be accrued to her income and will be deductible under her name.

This way you can understand that there is a clear transfer of ownership of assets in the form of profit, from the husband’s money on investment to the housewife’s gain on re-investment.

- GIFTS FROM RELATIVES

The gifts received in monetary terms from any relative are considered non-taxable under all circumstances. No slab rates are designed to impose any deductions on such transactions. The housewife is free from the hassle of filing an income tax return since the source of income is not taxable. The only condition that the housewife has to comply with is that if these gifts are not sent by relatives, then the threshold limit for exemption is at 50,000. This means if any person has received a gift surpassing that amount, then the housewife shall become liable to file the return.

This is because after crossing the threshold exemption limit, the gift becomes a part of the total income. And total income remains non-taxable if it is less than 2.5 lakhs. Therefore, while having a gift transaction made, one should ensure that the total limit does not exceed the aforementioned amount otherwise it will become compulsory to file an income tax return.

- EQUAL TAXATION

There was a time when women were offered rebates for the taxes that they were supposed to pay complying with the rules in the Income Tax act. However, as of the present day, the tax slabs are set equally without practising any gender bias. Even housewives have various sources of income that need to be ascertained and taxed for the welfare of the country.

Earnings from tuition or small and medium enterprises are also considered a part of this taxable income group. The trend changed in 2012-13 when the rebates based on gender bias were abolished and a common to all slab rate pattern was set. Along with bringing ease to the system, it has also ensured transparency on the accounts of single earning members in the family. No husband can use his wife’s account to commit tax fraud or gain any exemption for his income, exceeding the threshold limit.

- MONEY FOR HOUSEHOLD EXPENSES

Any supply of money that records a transaction from a husband’s account to his wife’s account for the purpose of fulfilling household expenses shall not be accountable for any tax deduction under any slab rate. This case is similar to that of the husband’s money being invested by the housewife. The situation clearly indicates that this source of income should be taxed upon the husband as it is his money that is being shared.

If the housewife is receiving any amount of sum from the husband for fulfilling expenses, then she does not have to file the ITR or pay taxes for the same. You may have seen workers who have migrated to distant urban places for work usually transact online while sending their family money. This is not taxable on part of the housewife but will be considered as the husband’s income.

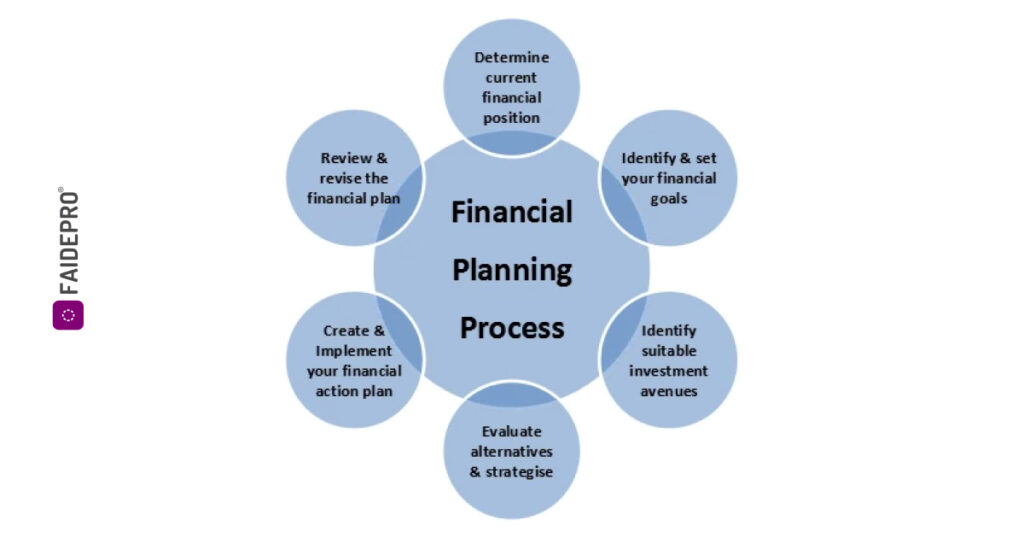

After understanding the different sources of income that are taxable for a housewife, there are other important things to know about taxes and financial planning.

- Any person can file the ITR without having to pay taxes. The income tax return is a statement which holds the account for your incomes and expenses and taxable projects. It is NOT compulsory that only persons having to pay taxes can file an ITR. Any person falling ahead of the threshold exemption is only entitled to pay the taxes. Thus, one should not live around such myths about taxes.

- The documentation while filing an ITR needs to be to the point and appropriate. It is an important aspect of taxation as it provides proof of your transactions. Many bills also help in ascertaining the financial stability that a person has to offer. For more details on what documents are important, you can contact CA firms for better services. They offer great details to ease the process of filing these returns.

Conclusion

Filing taxes is an important step for our country’s development. Therefore, it must not be compromised. One must avoid delaying the taxation process as it can lead to huge penalties. The housewives must be aware of their rights and obligations as informed citizens of the nation.

Also Read: What is Taxability of Cash Back – Let’s understand the concept