The deadline for filing annual returns under the Goods and Services Tax (GST) for the fiscal year 2017-18 has been extended to March 31, 2019, from December 31, 2018. Between July 2017 and March 2018, all taxpayers who registered under the GST Act must file an annual return in form GSTR 9 (for regular taxpayers) or GSTR 9A (for non-regular taxpayers) (for composite taxpayers).

Taxpayers with a turnover of more than Rs. 2 crores in the Financial Year (FY) 2017-18 will be required to have their books of accounts audited under GST provisions by a CA/CMA and send a reconciliation statement in form GSTR-9C, approved by a CA/CMA, with their annual return.

As a registered taxpayer, it is your duty to comply with the GST provisions. You will be penalized and charged late fees if you do not comply. To prevent a last-minute scramble when filing annual reports, have all the necessary information on hand. The CA services for tax can make this process easier for you. Just have a look! Let’s speak about the five things you need to do before filing your annual returns for FY 2017-18.

1.The following is a list of all tax invoices, as well as the reconciliation of such invoices:

First and foremost, you should have a list of all tax invoices released from July 2017 to March 2018. It’s best if you separate the tax invoices by GSTIN and double-check that the total amount of all tax invoices suits the turnover in the audited financial statements.

It’s likely that between July 2017 and September 2018, you updated any invoices from the fiscal year 2017-18. Such invoices must be checked before being recorded in the annual return. Any disparity in the invoices may result in GST non-reporting or incorrect reporting. Furthermore, caution must be taken when considering transactions that have not been accounted for in the books but are subject to GST, such as free stock transfers between units of the same business.

2. GST Audit:

If your turnover in the fiscal year 2017-18 was more than Rs. 2 crores, you would be subjected to a GST audit. If you haven’t started your GST audit yet, you should do so right away because the annual returns must be accompanied by a qualified reconciliation statement in GSTR 9C and audited financial statements in certain situations.

GST audits will cover the full spectrum of transactions made during the year, making them critical for identifying inconsistencies and taking prompt corrective measures to avoid potential litigation.

3. If valid, get ready to file two annual returns:

Previously, if you chose the composition scheme under GST and then changed your status to a ‘Regular Taxpayer,’ you had to file two annual returns, GSTR 9 and GSTR 9A, for the respective periods by the due date.

For example, if you filed GSTR 9A for the months of July 2017 to October 2017 and GSTR 9 for the months of November 2017 to March 2018, you will have to file GSTR 9A for the months of July 2017 to October 2017 and GSTR 9 for the months of November 2017 to March 2018. If this happened last year, brace yourself and make a note of all the information for GSTR 9 and 9A.

4. Meet the reporting guidelines:

a. HSN supply list for all inbound supplies: The list of HSN codes for all inbound supplies for FY 2017-18 should be kept on hand; this is an additional requirement in the annual return, while periodic returns such as GSTR 3B never asked for this information. To file error-free annual reports, you can locate and extract the HSN wise description from the purchase register as soon as possible.

b. HSN’s list of all inbound supplies: The list of HSN codes for all inbound supplies for FY 2017-18 should be kept on hand; this is an additional requirement in the annual return, while periodic returns such as GSTR 3B never asked for this information. To file error-free annual reports, you can locate and extract the HSN wise description from the purchase register as soon as possible. For those who did not keep track of their HSN wise transactions during FY 2017-18, this requirement could take some time. If you haven’t yet, you have plenty of time to find and report it in your purchase register before filing your annual return.

c. For reporting purposes, the ITC claimed in GSTR-3B must be divided into three categories: inputs, input facilities, and capital goods. This was never mentioned as a condition in the GSTR-3B that was submitted. A proper accounting system for each transaction, such as capital goods, services, and goods, would be beneficial.

You should be very cautious when reporting the ITCs, you’ve claimed, and keep in mind that you won’t be able to assert any ITCs you haven’t used, and you won’t be able to reverse any ITCs you’ve claimed in your annual return.

5. List and reconciliation of all amendment entries:

Finally, a list of all the amendment entries made in the FY 2018-19 periodic GST returns relating to invoices raised in FY 2017-18 should be prepared. Ensure that by October 25, 2018, a list of all FY 2017-18 amendment entries published in the periodic returns for the months of April to September is available.

Getting all of the details needed to file GST annual returns in one location takes a long time. It is preferable for you to begin the process of reconciliation and, if necessary, GST auditing as soon as possible. To prevent the repercussions of an inaccurate annual return, a taxpayer must be prepared with audited financial reports for each registration. So far, there is no provision for revising the annual return. As a consequence, by recalling these points, you can ensure that your annual reports are filed correctly.

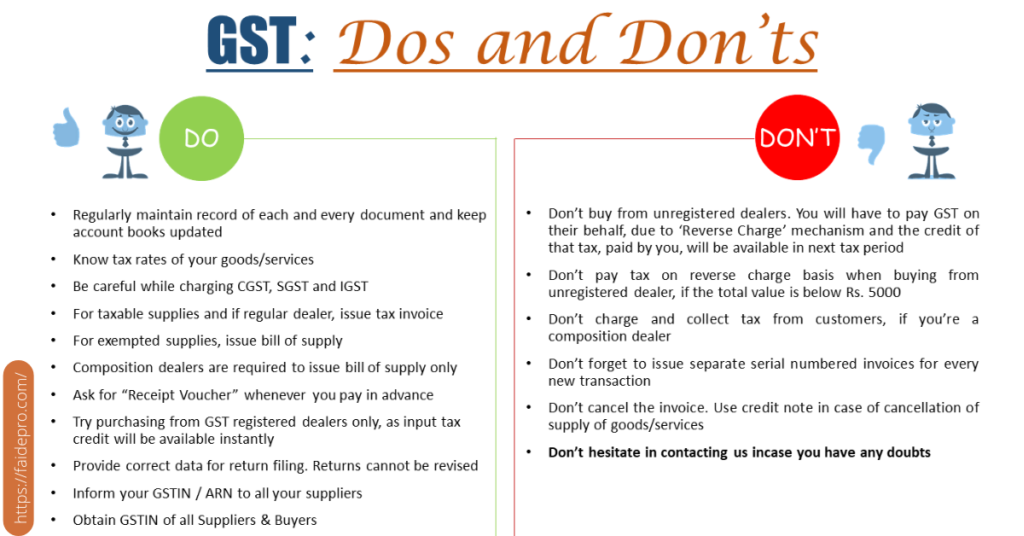

Dos

1. Make sure you file your GST returns on time.

Unlike previous indirect tax rules, GST requires a variety of returns and forms to be filed and submitted. Ensure that all GST returns are filed within their respective due dates. This is one of the most basic compliances that can help a company reduce interest, late fees, and notifications.

2. In GSTR-1, enter accurate data.

When filing the GSTR-1 return, there are a number of fields to fill out. After a return has been filed, the GSTN does not authorise it to be amended. Although this is inconvenient for taxpayers, a little care during data entry would ensure that no reconciliations or rectifications are needed in subsequent months’ returns.

3. Maintain accurate records

This is essential for a GST audit. Even if they are not subject to a GST audit, all companies should maintain appropriate records in order to comply with the legislation. Purchase and sale registers, fixed asset registers, payment challans, e-way bills, and so on are examples. If adequate documentation is kept, the reconciliation process can be much easier in the case of a notice of scrutiny, or even when the books of records are closed.

4. Make sure your returns and books of accounts are in sync.

Businesses should perform this process on a monthly basis rather than waiting for the end of the year to reconcile their returns with their books of accounts. The practise of timely reconciliation would allow any mistakes and omissions to be identified. This can be changed in a following month’s return rather than at the end of the year, saving interest and fines if necessary.

5. Reconcile the E-way Bills released with the GSTR-1 Invoice Info.

The data recorded in the GSTR-1 should be aligned with the e-way bills provided by all taxpayers. If the data does not fit, this may be one of the reasons why reports are sent to taxpayers. The failure to reconcile E-way bill data with GST returns will also trigger difficulties during GST audits and the preparation of the annual GST return.

6. A Reconciliation and Comparison of Returns

Taxpayers will benefit greatly from this exercise, which will help them not only in the filing of their annual report, but also in the event of a GST audit. Taxpayers should compare their GSTR-3B returns to their GSTR-2A and GSTR-1 returns, as well as their other tax returns. Make sure that all of the information matches.

7. Once you file your annual report, make sure your returns are correct and up to date.

GST return filers should make sure that all pending changes to the monthly returns are done on time. If this process is not followed, there could be a discrepancy between the year-end returns and the annual return. As a result, all reconciliations should be completed and any differences should be resolved before filing the annual return.

8. Recognize the Reverse-Charge Mechanism Provisions

The government continues to issue notices about the Reverse-Charge Mechanism’s provisions. Any company should make sure that they are up to date on these rules. Taxpayers should also be aware that input tax credit cannot be used to make reverse-charge payments, which must be made in cash.

9. Notify the GST Authorities of Changes in Your Company

All GST registered persons must notify the GST authorities of any changes to the details they have given about their registration. Such changes should be reported to the authorities within 15 days. The application, along with the necessary documentation, should be submitted via the GST portal.

10. Get a GST audit if you have a turnover of more than 2 crores rupees

Any registered dealer whose annual turnover exceeds Rs 2 crore is required to have his accounts audited by a CMA or a CA. His audited returns, as well as his audited reports and reconciliation statements, must be submitted.

Don’ts

1.Paying Tax Under the Wrong GST Head

Taxpayers make errors like paying tax under the wrong GST head, or paying interest under the wrong tax head, and so on. When it comes to GST payments, be extra careful because the GSTN does not allow for the inter-user of taxes. Payments made under the incorrect tax heads will result in an unfavorable working capital situation.

2. Mark Nil-rated supplies as zero-rated supplies, and vice versa.

Users often make this mistake, misclassifying zero-rated supplies as nil-rated and vice versa. Export supplies and supplies made to a SEZ are zero-rated supplies, while nil-rated supplies are supplies with a 0% tax rate. Users should be cautious when entering data into GST returns because input tax credit cannot be claimed on nil-rated supplies.

3. Ignore Filing Your Zero Return

This is an extremely critical point that many taxpayers overlook. If a company has no transactions for a given time, it is necessary to note to file a Zero return for that period. This will also make it easier to file future returns, as the GSTN prohibits filing returns in such circumstances where previous period returns have not been filed.

4. Use of Incorrect Tax Rates

The government publishes notices with the most recent tax rates, as recommended by the GST council, on a regular basis. All companies must keep current on these rate increases and pay GST at the current rates. There are also different rates for different goods and services depending on whether or not input tax is claimed. When issuing GST invoices, it is necessary to ensure that the correct tax rate is applied.

5. Pay the tax if it is to be paid using the reverse charge method

This refers to all companies whose invoices are subject to reverse-charge GST. Such businesses must determine whether the receiver must pay a reverse-charge and must not charge GST while issuing invoices. This will avoid double taxation and the needless hassle of depositing the tax when the liabilities lie with recipients.

6. Forget about paying taxes on goods sent for work (After the Expiry of The Specified Period)

In the case of job-work, if products sent on job-work are not returned within the specified time span, the principal manufacturer is liable to pay tax and interest (1 year in the case of inputs and 3 years in the case of capital goods). When it comes to moulds and dies, jigs and fixtures, tax is required to be paid by the job-worker, or by the Principal Manufacturer if the job-worker doesn’t have a GST registration.

7. Submit a claim for an ineligible input tax credit

Payments not made to suppliers within 180 days, inputs used partly for personal purposes, capital goods sold, free samples given to customers or business partners, goods destroyed, and so on are all examples of situations where input tax credit is not available. Input tax credit requirements must be held up to date by taxpayers. Any unauthorised use of input tax credit may result in notifications from the GST department.

8. Don’t Forget to Apply for Transitional Credit

Owing to a technical glitch, the government has extended the deadlines for filing TRAN-1 and TRAN-2 forms to March 31st and April 1st, respectively. As a result, users can demand transitional credit from before the GST period until the extended due dates. These are some of the forms a tax filer can remain GST-compliant and stop GST department notices. It is important that an organization’s legal processes and obligations are not overlooked.

This is beneficial to the enterprise’s overall health and success. For GST registered companies, Clear Tax provides a FREE integrated tool to monitor and review their enforcement level for GST Returns submitted. Every GSTIN can now use the GST Health Review tool to obtain the following information in an excel spreadsheet:

• A review of the health check

• The status of GST returns filing

• Report GSTR-1 vs. GSTR-3B (tax difference)

• Record GSTR-3B vs. GSTR-2A (ITC difference)

• Report on Vendor Compliance

Hiring CA services for business will guide you through all the steps given above and you have to file ITR or GST returns in the proper guidance of CA. They can save your money and most importantly they help to avoid the hassle of this process.

Read This Blog: Recent VAT Change for Dealers to Selling Goods Online in India – 2021